The Union Budget of 2023 brought in a host of new policies, aimed at improving the Indian ecosystem and uplifting various sectors. This budget gained significant attention for its plethora of fresh policies that have the potential to enhance industrial, rural, and urban development in India.

One notable highlight of the Amrit Kaal Budget 2023 was the significant changes made to the income tax slabs. Additionally, another noteworthy policy introduced was the 20% Tax Collected at Source (TCS) on Foreign Remittance under the Liberalized Remittance Scheme.

In the case of Foreign Remittance Transactions, this tax can be collected from you when you send money abroad.

It’s important to note that sending money abroad encompasses more than just sending it to someone. It could also include activities like traveling abroad, shopping, investing overseas, purchasing assets, and so on.

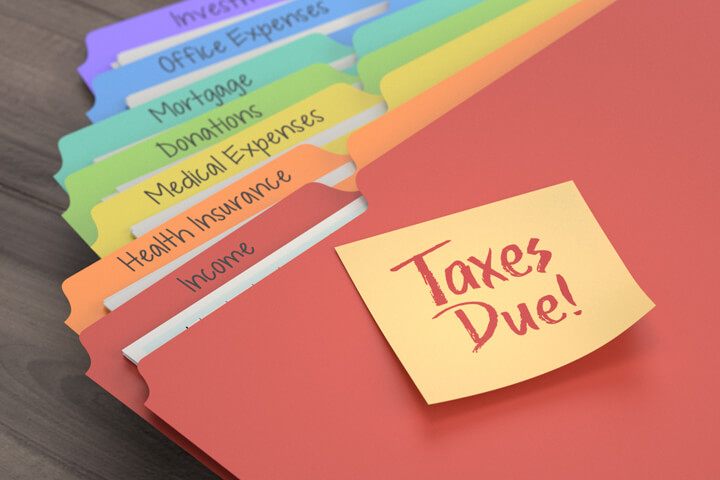

What transactions come under the Liberalised Remittance Scheme (LRS)?

Under the Liberalised Remittance Scheme (LRS), residents are permitted to transfer up to USD 250,000 per financial year for a wide range of purposes. These purposes encompass education, travel, medical treatment, support for close relatives, gifts and donations, employment abroad, emigration.

Latest Update on Taxation for Foreign Remittance

| Remittance Type | Current TCS | Proposed TCS |

| Education loan from financial institution as per section 80E | 0.5% of the aggregate of the amounts in excess of Rs 7 Lakh | No Change |

| For the purpose of education other than above mentioned | 5% of the aggregate of the amounts in excess of Rs 7 Lakh | No Change |

| Overseas Travel Packages | 5% without any threshold limit | 20% without any threshold limit |

| Any other case | 5% of the aggregate of the amounts in excess of Rs 7 Lakh | 20% without any threshold limit |

This is likely to be applicable from 1st July 2023.

What happens if you don’t have a PAN or Aadhaar card?

If you don’t have it the rate of TCS can be doubled up to 40%

Can you get this money back?

Yes, When you file your Income Tax returns for the assessment year, any TCS collected will automatically be shown as TCS paid to the Income Tax Department. You can use this TCS to offset your Income Tax payable.

Let take an example, Mr. Sachin has a taxable income of 10,00,000 and on this 117000 is total tax payable, and he visited on dubai tour which cost 2,00,000 and he was charged 20% TCS i.e 40,000. Now this 40,000 will be adjusted with net payable tax he has now paid only 77,000. If sachin did not have tax payable, then 40,000 would have been refunded to him after fillings.

In conclusion, the Union Budget of 2023 introduced significant changes to the taxation of Foreign Remittance transactions under the Liberalised Remittance Scheme (LRS). Starting from 1st July 2023, a 20% Tax Collected at Source (TCS) will be levied on various transactions such as overseas travel packages and other cases of foreign remittance. This new policy aims to generate revenue and regulate the flow of funds outside the country. It’s important for individuals to be aware of these changes and their implications when sending money abroad. However, individuals can claim a refund or offset their Income Tax payable by using the TCS amount while filing their Income Tax returns. As always, it is recommended to consult with a tax professional and stay updated on the latest government regulations for accurate and detailed information.