Before we dive into the nitty-gritty details of income tax, let’s first understand what income tax is all about.

Income tax is a direct tax levied on the income earned by an individual or a company in a financial year. It is calculated based on the income tax slab rates assigned by the government. Income tax is an essential source of revenue for the government, which it uses to fund various public services and welfare schemes.

But why is income tax important? For starters, it is a legal obligation that every taxpayer must comply with. Failing to do so can result in hefty fines and penalties. Moreover, paying income tax also reflects one’s contribution towards the development of the nation.

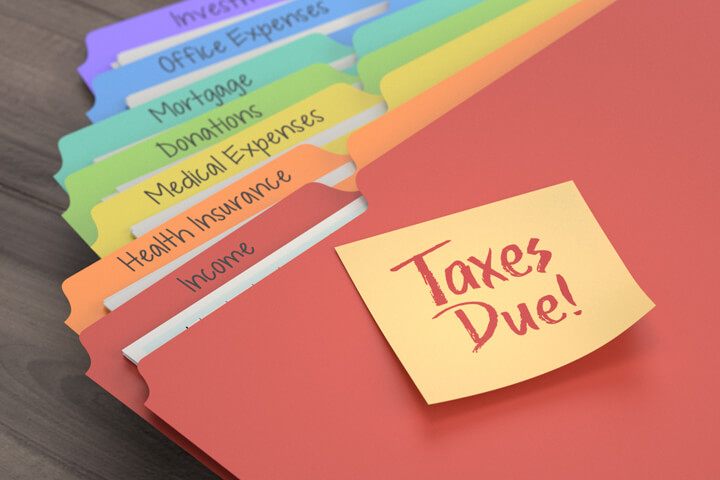

Now that we know the basics of income tax, let’s take a quick look at the income tax filing process in India. The process involves filing an income tax return (ITR) with the government, which is basically a document that contains details of your income, deductions, and tax payable. It is mandatory for individuals whose gross total income exceeds the minimum threshold limit specified by the government to file an ITR.

Are you ready to explore the world of income tax? Let’s get started

Tax saving options

Now that we have a basic understanding of income tax filing and its importance, let’s dive into the different tax-saving options that are available to us. The government provides several tax-saving options, which can help reduce our taxable income and

ultimately lower our tax liability.

Deductions under Section 80C:

One of the most popular ways to avail tax benefits is to invest in schemes that come under Section 80C. Under this section, investments up to Rs 1.5 lakh can be claimed as a deduction from your total income. Some popular investment options that are covered under this section include Public Provident Fund (PPF), Equity linked Saving Scheme (ELSS), National Savings Certificate (NSC), and so on.

But did you know that even your child’s tuition fees paid to a recognized institution can be claimed under this section? This is just one of the many lesser-known deductions that can significantly reduce your tax liability.

Exemptions for house rent allowance:

House Rent Allowance (HRA) is a common component of a salary package. It is given by employers to their employees to help them pay for their rent. The HRA amount that is received from an employer is exempt from tax, subject to certain conditions. These conditions include the employee not owning a house in the city they reside in and the rent paid being more than 10% of their basic salary.

However, if you are self-employed or do not receive HRA as a part of your salary, you can still claim a deduction for the rent paid. This can be claimed under Section 80GG, subject to certain conditions. Ensuring that you claim the deduction that you are eligible for can help reduce your tax liability.

Medical reimbursement deductions:

Medical costs are one of the major expenses that one incurs in their lifetime. To help taxpayers cope with these expenses, the government provides tax exemptions under Section 80D. This section allows individuals to claim tax deductions for the medical insurance premium paid for themselves, their spouse, dependent children, and parents.

Additionally, deductions can also be claimed for the expenses incurred on preventive health check-ups. These deductions can go up to Rs 1.5 lakh depending on the age of the insured and the number of members covered under the policy.

Investments in National Pension Scheme (NPS):

The National Pension Scheme (NPS) is a retirement-focused investment scheme. It provides tax benefits on both contributions made and the maturity amount received.

Under Section 80 CCD(1), one can claim a deduction up to Rs 1.5 lakh for contributions made to the NPS account.

Moreover, under Section 80 CCD(2), an additional deduction of 10% of salary (for salaried individuals) or 20% of gross income (for self-employed individuals) can be claimed towards the contribution made by the employer to the employee’s NPS account.

Deductions for education loans:

Education is one of the most significant expenses that we incur in our lifetime. To encourage individuals to invest in their education, the government provides a tax deduction on the interest paid towards education loans. The deduction can be claimed under Section 80E and is available for any loan taken for higher education, whether for yourself, your spouse, or your children.

However, the deduction can only be claimed for a period of 8 years, and the loan has to be taken from a financial institution or a charitable institution approved by the government.

Contribution to Public Provident Fund (PPF):

The Public Provident Fund (PPF) is a long-term investment option that provides tax benefits under Section 80C. It has a lock-in period of 15 years and a minimum contribution of Rs 500 per year. The interest earned on the PPF account is tax-free, and

the maturity amount received is also tax-free. Moreover, the PPF account can be opened in the name of a minor child, providing an excellent investment option for parents looking to invest for their children’s future.

Deductions for donations made to charities:

Contributions made towards charitable institutes can also be claimed as a tax deduction under Section 80G. The deduction can go up to a maximum of 50% of the contribution made, subject to certain limitations.

Also, not all donations are eligible for a deduction, such as those made in the form of cash and those made to foreign institutions. Hence, it is essential to ensure that the charitable institution you are donating to is registered and recognized under Section 80G.

Tax benefits for first-time homebuyers:

The government provides several tax benefits to encourage individuals to invest in real estate. First-time homebuyers can claim a tax deduction on the interest paid towards the home loan under Section 80EEA. This deduction can go up to Rs 1.5 lakh and is subject to certain conditions, such as the cost of the house being less than Rs 45 lakh.

Additionally, one can also claim a tax benefit under Section 24 for the interest paid towards the home loan. This deduction can go up to Rs 2 lakh but is subject to certain limitations.

In conclusion, availing these tax-saving options can significantly reduce your tax liability. Maximizing these deductions through proper planning can help you save a considerable amount of money in the long run. So, ensure that you make use of these options to optimize your tax savings while fulfilling your financial goals.

Types of business tax benefits

As a business owner, tax time can be a stressful time, but did you know that you can

actually benefit from paying taxes? Yes, you read that right. The government offers tax benefits to businesses in India, so

you can actually save some money while fulfilling your tax duties. Let’s dive into some of the popular tax benefits available for businesses. Under Section 80C, businesses can claim deductions for investments in tax-saving instruments like Public Provident Fund, National Pension Scheme, and Equity Linked Savings Scheme. This can help businesses reduce their taxable income and save money.

For start-ups, there’s the Start-Up India Scheme, which provides tax exemptions for the first three years of operation, along with various other benefits like patent registration. The Export Promotion Capital Goods Scheme allows duty-free imports of capital goods, which can be a boon for export-oriented businesses.

And if you’re a start-up in certain sectors, you can even enjoy a tax holiday for the first seven years of your operation. Talk about a good deal! Isn’t it amazing how paying taxes can actually benefit your business? So, go ahead and

make use of these tax benefits available to you.

Tax benefits for small businesses

Alright folks, now that we have covered the basics of tax benefits for businesses in India, lets get into the nitty-gritty details of the tax benefits that small businesses can avail themselves of.

First up, the Presumptive Taxation Scheme. If you are a sole proprietor, freelancer, or small business owner with a turnover of less than Rs. 2 crores, you can take advantage of this scheme. It saves you the hassle of maintaining detailed accounts of your

business income and expenses. Instead, you just pay taxes on a percentage of your turnover.

Next up, the lower corporate tax rate for small companies. If you have incorporated your business as a company and have a turnover of less than Rs. 50 crores, you are eligible for a lower corporate tax rate of 25% instead of the standard 30%. That’s a 5% savings right there, and who doesn’t love savings, am I right?

Last but not least, relaxation in GST compliance. Small businesses (those with a turnover of less than Rs. 1.5 crores) can opt for the Composition Scheme. Under this scheme, businesses can pay a fixed percentage of their turnover as GST instead of the

regular GST rates. In addition, those under the Composition Scheme have fewer compliance requirements than businesses not registered under it.

There you have it, folks. Tax benefits that small businesses in India can take advantage of. Now, its time to put on your thinking caps and decide which benefits are best suited for your business. Who says taxes have to be boring? Happy saving!

Tax benefits for medium and large businesses

Tax Benefits for Medium and Large Businesses Now it’s time to dive deep into the tax benefits that medium and large businesses can take advantage of! Corporate tax deductions are one of the most well-known tax benefits that businesses enjoy.

By deducting certain expenses, the business can reduce the amount of taxable income, which, in turn, lowers the amount of taxes owed to the government.

Then there are the weighted deductions under the Income Tax Act. This means an extra deduction on actual expenses incurred in specific areas such as scientific research, skill development, and the promotion of family planning. Plus, tax exemptions for SEZ units can be an enormous advantage for larger businesses.

But wait, there’s more! Tax breaks for research and development are also available for businesses that are looking to innovate. These are just a few of the many tax benefits that medium and large businesses can take advantage of to reduce their tax liabilities.

Of course, these tax benefits come with certain conditions, such as the need to maintain proper records and submit detailed reports. But if you’re willing to keep up with the requirements, the benefits can be significant.

So, if you’re running a medium or large business, make sure you’re exploring all the tax benefits available to you. It’s not just about saving money, it’s about maximizing your profitability and growth potential.

Other tax benefits

Tax benefits aren’t just limited to deductions and exemptions. There are other benefits as well that businesses should be aware of. For instance, if a business incurs losses, those losses can be carried forward and set off against future profits. This can significantly reduce tax liability in the future.

Additionally, the Minimum Alternate Tax (MAT) provision ensures that companies that report profits in their financial statements but pay zero or very minimal tax due to various exemptions, deductions, and incentives, are not able to completely avoid paying taxes. The Tax Residency Certificate (TRC) is also important, especially for businesses that operate in multiple countries. The TRC certifies that a business is a resident of one country for tax purposes and can claim tax benefits under the Double Tax Avoidance Agreement (DTAA) that India has with many countries.

While these may not be as extensively discussed as other tax benefits, they can still significantly impact a business’s tax liability. Make sure to take advantage of every opportunity to reduce tax and increase profits, even if it means carrying forward losses or jumping through a few extra hoops to get a TRC.

Conclusion

Finally, it’s done! I hope you found this guide helpful and have a clear understanding of income tax filing in India. Remember, income tax filing is not a one-time task but a continuous process that requires your attention and compliance.